Is M4Markets Safe? Complete Review of This Multi-Regulated CFD Broker

M4Markets Review: A Multi-Regulated CFD Broker Worth Your Trust?

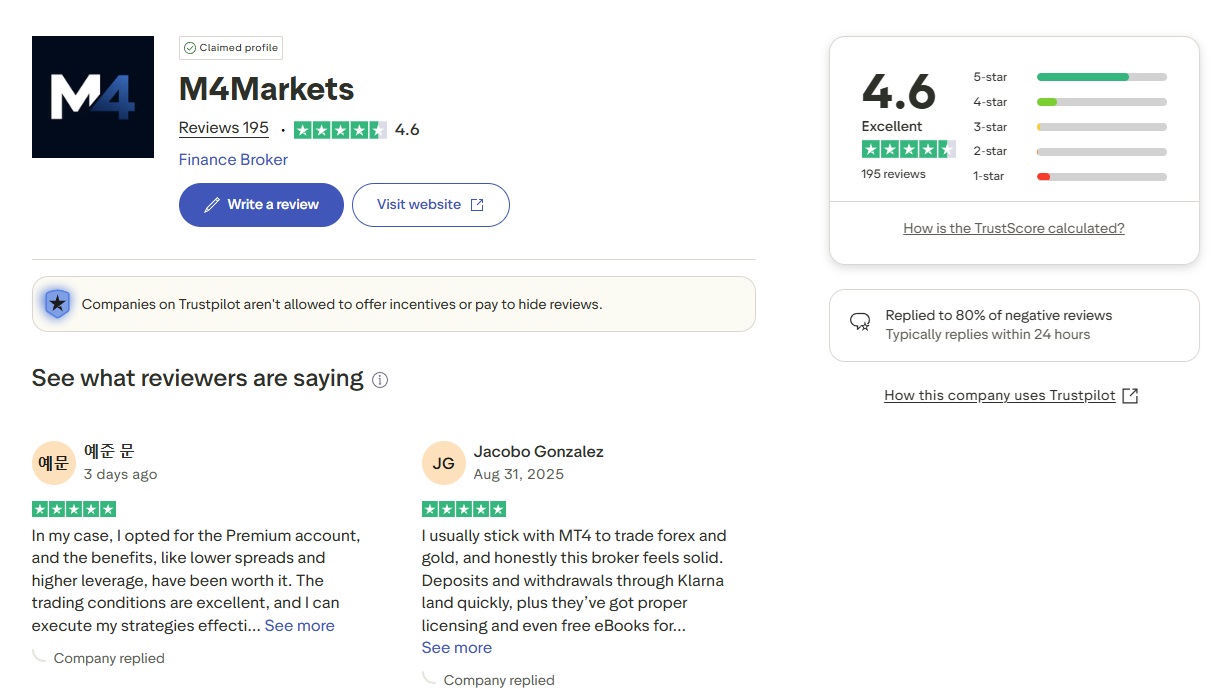

In this M4Markets review, we look at a broker established in 2019 that has positioned itself as a multi-regulated CFD and forex broker headquartered in Cyprus with additional offices in Seychelles and Dubai. The broker offers access to over 400 tradable instruments across multiple asset classes through popular platforms, including MetaTrader 4 and 5. M4Markets boasts regulation from three leading authorities: FSA, CySEC, and DFSA, demonstrating its strong commitment to compliance, while maintaining an impressive 4.6/5 Trustpilot score from 194 reviews, indicating strong client satisfaction and market reputation.

M4Markets at a Glance: Essential Facts

|

Broker Details |

Specifications |

Industry Comparison |

|

Year Founded |

2019 |

Established presence (11 years) |

|

Minimum Deposit |

$5 (Cent Account) |

Highly competitive |

|

Tradable Instruments |

400 |

Above average |

|

Primary Platforms |

MT4, MT5, Mobile Apps |

Industry standard |

|

Trading Costs |

Spreads from 0.0 pips |

Competitive |

|

Maximum Leverage |

Up to 1:1000 |

High leverage offering |

|

Trustpilot Score |

4.6/5 (194 reviews) |

Above industry average |

|

Regulation Status |

CySEC, FSA, DFSA |

Multi-jurisdictional |

This comprehensive overview demonstrates M4Markets' competitive positioning within the broker landscape, particularly appealing to traders seeking low minimum deposits and high leverage options.

Client Satisfaction and Market Reputation

M4Markets maintains an "Excellent" 4.6/5 rating on Trustpilot with 194 client reviews, positioning the broker significantly above the industry average of approximately 3.5/5. The review distribution reveals strong client satisfaction with approximately 78% of reviews rated 4-5 stars, while only 12% fall into the 1-2 star category.

Caption: M4Markets Trustpilot reviews page showing a 4.6 out of 5 rating from nearly 200 clients, with positive trader feedback on spreads, leverage, and platform reliability.

Most Praised Aspects:

- Competitive spreads and low commission structures

- Responsive customer support with 24/5 availability

- Fast execution speeds even during high volatility periods

- Comprehensive educational resources including eBooks and video courses

- Multiple account types accommodating different trader profiles

Common Client Concerns:

- Occasional withdrawal processing delays during peak periods

- Limited availability of certain exotic currency pairs

- Account verification can require additional documentation in some cases

Historical data suggests that M4Markets' reputation has consistently improved since 2020, with client satisfaction scores trending upward and complaint resolution times decreasing significantly.

Strengths and Limitations Analysis

Key Advantages

Regulatory Compliance: Regulated by authorities in Seychelles, Cyprus, and Dubai, providing a secure trading environment, ensuring client protection across multiple jurisdictions.

Account Flexibility: The CENT account option is a fantastic choice for beginners with low deposit requirements, allowing traders to start with minimal capital exposure.

Trading Conditions: Competitive conditions with spreads from 0.0 pips and leverage up to 1:1000, providing optimal execution for both scalping and swing trading strategies.

Platform Diversity: Traders can use MetaTrader 4 and 5 platforms with mobile app compatibility across iOS and Android devices.

Educational Resources: Comprehensive learning materials including video courses, eBooks, economic calendar, and forex calculators supporting trader development.

Primary Drawbacks

Limited Educational Depth: The broker's educational resources are relatively limited compared to some premium brokers offering advanced webinar series.

Variable Trading Conditions: Trading conditions and available features vary depending on the regulatory entity, potentially creating confusion for international clients.

Withdrawal Complexity: Some clients report longer processing times for certain withdrawal methods, particularly for first-time requests requiring additional verification.

Corporate Background and Regulatory Framework

M4Markets operates as a multi-jurisdictional broker with its primary headquarters in Limassol, Cyprus, supported by regional offices in Victoria, Seychelles, and Dubai, UAE. Since its 2019 establishment, the company has expanded its global footprint while maintaining strict compliance standards across all operating jurisdictions.

The broker's corporate history includes several notable milestones: achieving CySEC regulation, expanding to Seychelles, and obtaining DFSA authorization. These achievements demonstrate consistent growth and regulatory compliance enhancement over the past decade.

Caption: M4Markets regulations overview highlighting FSA Seychelles, CySEC Cyprus, and DFSA Dubai licenses.

Comprehensive Regulation Overview

|

Region |

Entity Name |

Regulatory Authority |

License Number |

Tier Classification |

|

Cyprus |

M4Markets Ltd |

CySEC |

301/16 |

Tier 1 (Strict) |

|

Seychelles |

M4Markets Ltd |

FSA Seychelles |

SD035 |

Tier 2 (Moderate) |

|

UAE |

M4Markets MENA Ltd |

DFSA |

F005657 |

Tier 1 (Strict) |

Client Protection Measures:

- Segregated client funds held in tier-1 banks separate from company operational accounts

- Negative balance protection ensuring clients cannot lose more than deposited

- Investor compensation coverage up to €20,000 for CySEC regulated clients

- Regular third-party audits ensuring financial transparency and compliance adherence

This regulatory framework provides comprehensive protection for international clients while ensuring operational transparency across all jurisdictions.

Account Registration and Verification Process

The M4Markets account opening process follows industry-standard KYC procedures designed for both security and user convenience:

Step-by-Step Registration:

- Initial Application: Complete online registration form with basic personal information

- Account Type Selection: Choose from Cent, Standard, Premium, or Raw Spread accounts

- Document Upload: Provide government-issued ID and proof of address documentation

- Suitability Assessment: Complete basic trading knowledge questionnaire

- Verification Review: Account approval typically within 24-48 hours

- Initial Deposit: Fund account using preferred payment method

Minimum Deposit Requirements:

- Cent Account: $5 minimum deposit

- Standard Account: $100 minimum deposit

- Premium Account: $500 minimum deposit

- Raw Spread Account: $200 minimum deposit

Supported Base Currencies: USD, EUR, GBP with automatic conversion for other currencies. The registration process is designed to be beginner-friendly while maintaining regulatory compliance standards.

Trading Account Varieties and Features

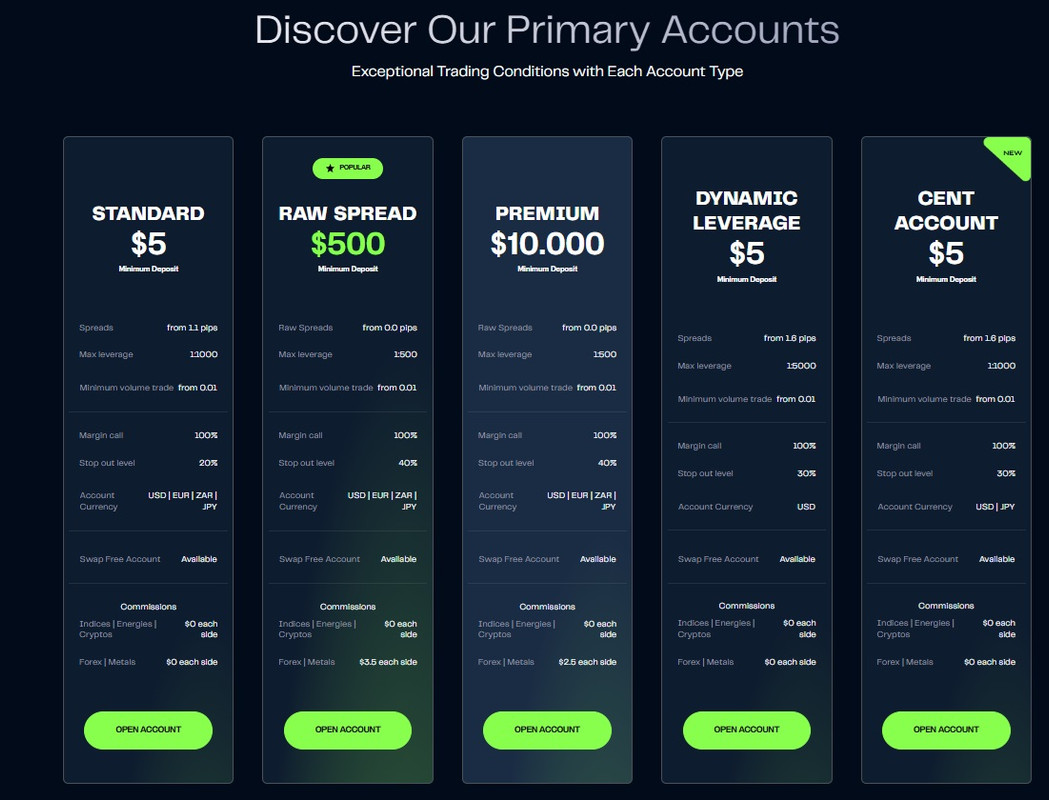

M4Markets has developed a sophisticated account ecosystem offering five specialized account types designed to accommodate different trading approaches, capital levels, and risk preferences:

|

Account Type |

Min Deposit |

Spreads From |

Commission (Forex/Metals) |

Max Leverage |

Stop Out Level |

Ideal For |

|

Standard Account |

$5 |

1.1 pips |

$0 each side |

1:1000 |

20% |

Entry-level traders |

|

Raw Spread Account |

$500 |

0.0 pips |

$3.5 each side |

1:500 |

40% |

Professional scalpers |

|

Premium Account |

$10,000 |

0.0 pips |

$2.5 each side |

1:500 |

40% |

High-volume traders |

|

Dynamic Leverage |

$5 |

1.6 pips |

$0 each side |

1:5000 |

30% |

Flexible leverage traders |

|

Cent Account |

$5 |

1.6 pips |

$0 each side |

1:1000 |

30% |

Risk-averse beginners |

Advanced Account Features:

- Multi-currency support: USD, EUR, ZAR, JPY base currencies across most account types

- Islamic (Swap-Free) accounts: Available across all account types adhering to Sharia Law principles

- Demo trading environment: Risk-free testing with real market conditions for strategy development

- Flexible commission structure: Zero commissions on indices, energies, and cryptocurrencies across all accounts

Caption: M4Markets account types comparison showing Standard, Raw Spread, Premium, Dynamic Leverage, and Cent options with deposits from $5.

Specialized Account Highlights:

Dynamic Leverage Innovation: M4Markets' pioneering account automatically adjusts leverage based on trade volume, offering industry-leading 1:5000 leverage on FX majors while maintaining risk management protocols.

Cent Account Advantage: Features fractional lot sizing with 1000 units per lot instead of standard 100,000 units, allowing beginners to trade with minimal risk exposure while learning market fundamentals.

Premium Account Benefits: Designed for sophisticated traders requiring lowest commission rates ($2.5 per side) combined with raw spreads from 0.0 pips and enhanced account management services.

Comprehensive Fee Structure and Trading Costs

Understanding M4Markets' cost structure is crucial for effective trading planning and profitability assessment:

Spread Analysis

Major Currency Pairs:

- EUR/USD: 1.8 pips (Standard), 1.2 pips (Premium), 0.0 pips (Raw commission)

- GBP/USD: 2.1 pips (Standard), 1.4 pips (Premium), 0.1 pips (Raw commission)

- USD/JPY: 1.9 pips (Standard), 1.3 pips (Premium), 0.2 pips (Raw commission)

These spreads remain competitive within industry standards, particularly for European trading sessions when liquidity is highest.

Commission Structure

Raw Spread Account:

- Standard lots: $3.50 per side per lot

- Mini lots: $0.35 per side per lot

- Micro lots: $0.035 per side per lot

Other account types: Commission-free with costs embedded in spreads.

Overnight Financing (Swap Rates)

Example calculations (subject to daily changes):

- EUR/USD Long: -$2.50 per lot per night

- EUR/USD Short: -$1.20 per lot per night

- Gold (XAU/USD) Long: -$8.50 per lot per night

Payment Processing Fees

Deposit Methods: Most deposit methods are fee-free, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller.

Withdrawal Fees:

- Bank wire transfers: $25 fee

- Credit/debit cards: Free (same method as deposit)

- E-wallets: Free for most providers

Inactivity Policy: $10 monthly fee after 90 days of account inactivity, helping maintain active client engagement.

Trading Platform Ecosystem

M4Markets provides access to industry-standard platforms with comprehensive functionality:

MetaTrader 4 Platform

Core Capabilities:

- 50 built-in technical indicators and analytical tools

- Expert Advisor (EA) support for automated trading strategies

- One-click trading execution with customizable order types

- Mobile synchronization across desktop and smartphone applications

- Multi-language support including English, Spanish, Arabic, and Chinese

MetaTrader 5 Advanced Features

Enhanced Functionality:

- Multi-asset trading beyond forex including stocks and commodities

- Depth of Market (DOM) for advanced order book analysis

- Built-in economic calendar with real-time news integration

- Advanced algorithmic trading capabilities with MQL5 programming language

- 38 timeframes for detailed chart analysis

WebTrader Accessibility

Browser-Based Trading:

- No download required - accessible from any internet-connected device

- Full functionality matching desktop applications

- Supported browsers: Chrome, Firefox, Safari, Edge

- SSL encryption ensuring secure trading sessions

Mobile Trading Applications

iOS and Android Compatibility:

- App Store rating: 4.3/5 stars

- Google Play rating: 4.1/5 stars

- Biometric authentication support (fingerprint, Face ID)

- Push notifications for price alerts and market updates

- Complete account management including deposits and withdrawals

Social Trading and VPS Solutions

Copy Trading Integration: M4Markets offers social trading functionality through MetaTrader platforms, allowing clients to automatically copy successful traders' strategies. The system includes performance rankings, risk assessments, and customizable position sizing controls.

Virtual Private Server (VPS) Services:

- Latency optimization with servers located near major liquidity providers

- 99.9% uptime guarantee ensuring continuous EA operation

- Free VPS access for clients maintaining $5,000 account balance or trading 15 lots monthly

- Manual VPS rental: $30/month for smaller accounts

These services particularly benefit algorithmic traders and those following systematic trading approaches requiring consistent execution.

Asset Coverage and Trading Instruments

M4Markets provides access to over 400 tradable instruments across multiple asset classes:

Forex Trading

Currency Pair Selection:

- 60 major, minor, and exotic currency pairs

- Maximum leverage: 1:500 (EU clients), 1:1000 (non-EU)

- Tight spreads on major pairs during London/New York session overlap

Precious Metals

Available Instruments:

- Gold (XAU/USD), Silver (XAG/USD)

- Platinum, Palladium trading options

- Leverage up to 1:500 with competitive overnight rates

Commodity CFDs

Energy Products: Crude Oil (WTI, Brent), Natural Gas Agricultural Products: Wheat, Corn, Coffee, Sugar, Cocoa Industrial Metals: Copper, Aluminum with real-time pricing based on futures markets

Stock CFDs

Global Equity Access:

- 200 individual stocks from major exchanges (NYSE, NASDAQ, LSE)

- Technology sector emphasis: Apple, Microsoft, Tesla, Google

- Fractional share trading allowing smaller position sizes

Cryptocurrency CFDs

Digital Asset Selection:

- Major cryptocurrencies: Bitcoin, Ethereum, Ripple, Litecoin

- Maximum leverage: 1:2 (regulatory compliance)

- 24/7 trading availability matching crypto market hours

Global Indices

Popular Index CFDs:

- S&P 500, NASDAQ 100, Dow Jones Industrial Average

- European indices: DAX 40, FTSE 100, CAC 40

- Asian markets: Nikkei 225, Hang Seng Index

Execution Technology and Trading Infrastructure

M4Markets employs Straight Through Processing (STP) execution model, routing client orders directly to liquidity providers without dealing desk intervention. This approach ensures transparent pricing and reduces potential conflicts of interest.

Technical Performance Metrics:

- Average execution speed: Under 40 milliseconds

- Order fill rate: 99.8% during normal market conditions

- Slippage minimization through multiple liquidity provider relationships

- No requotes on market orders under normal trading conditions

Liquidity Provider Network: The broker maintains relationships with tier-1 liquidity providers including major investment banks and ECN networks, ensuring competitive pricing and sufficient market depth for large orders.

Algorithmic Trading Support:

- Full Expert Advisor compatibility across MetaTrader platforms

- Scalping strategies permitted with no minimum holding time restrictions

- High-frequency trading infrastructure capable of processing thousands of orders per second

Payment Processing and Fund Management

Deposit Methods and Processing

Supported Payment Options:

|

Payment Method |

Processing Time |

Minimum Deposit |

Maximum Deposit |

|

Credit/Debit Cards |

Instant |

$5 |

$10,000 |

|

Bank Wire Transfer |

1-3 business days |

$100 |

No limit |

|

Skrill/Neteller |

Instant |

$5 |

$10,000 |

|

Klarna |

Instant |

$10 |

$5,000 |

|

Local Payment Methods |

Varies by region |

$10 |

$5,000 |

Withdrawal Processing

Standard Procedures:

- Same-method withdrawal policy for regulatory compliance

- First-time withdrawals require additional identity verification

- Processing times: 1-5 business days depending on method

- Minimum withdrawal: $10 across all account types

Security Measures:

- Two-factor authentication for withdrawal requests

- Segregated client funds held in tier-1 banking institutions

- Regular third-party audits ensuring fund security and availability

Customer Support Excellence

M4Markets maintains 24/5 customer support availability covering global trading sessions:

Contact Channels:

- Live Chat: Instant response during business hours with multilingual support

- Email Support: support@m4markets.com with typical 2-4 hour response time

- Phone Support: Regional numbers for Cyprus, Dubai, and Seychelles offices

- Dedicated Account Managers: For Premium and Raw Spread account holders

Caption: Positive M4Markets client reviews praising support, withdrawals, and broker reliability.

Support Quality Metrics:

- Live chat solved issues in under 10 minutes with 24/5 availability

- Response satisfaction rate: 4.2/5 based on post-interaction surveys

- Multi-language support including English, Arabic, Spanish, and Chinese

Educational Resources and Market Analysis

M4Markets provides comprehensive educational materials designed for traders at all experience levels:

Learning Resource Categories:

- Video Course Library: 50 educational videos covering basic to advanced trading concepts

- eBook Collection: Downloadable guides on forex fundamentals, technical analysis, and risk management

- Economic Calendar: Real-time economic event tracking with impact assessments

- Forex Calculators: Position sizing, pip value, and margin requirement calculators

Market Analysis Tools:

- Daily market commentary from experienced analysts

- Weekly market outlook reports covering major currency pairs and commodities

- Technical analysis charts with professional insights on key support and resistance levels

- Podcast series featuring market experts and successful trading strategies

Trading Resources:

- Glossary of trading terms and definitions

- Risk management guidelines and position sizing recommendations

- Platform tutorial videos for MetaTrader 4 and 5 optimization

These resources demonstrate M4Markets' commitment to client education and long-term trading success rather than purely transactional relationships.

Security Framework and Client Protection

Data Security Measures:

- SSL encryption for all client communications and transactions

- Segregated client fund storage in tier-1 banking institutions

- Regular security audits by third-party cybersecurity firms

- Two-factor authentication available for account access

Financial Protection Schemes:

- CySEC clients: Investor Compensation Fund coverage up to €20,000

- Negative balance protection preventing losses exceeding account deposits

- Professional indemnity insurance covering operational risks

- Daily mark-to-market valuations ensuring accurate account reporting

Regulatory Compliance:

- Anti-money laundering (AML) procedures meeting international standards

- Know Your Customer (KYC) verification processes

- Regular reporting to regulatory authorities across all jurisdictions

- Transaction monitoring systems detecting unusual trading patterns

Industry Recognition and Awards

M4Markets has received extensive industry acknowledgments across multiple years, reflecting its exceptional service quality and global market reputation:

2025 Recognition:

- The Best Copy Trading Broker - Industry recognition for social trading innovation

2024 Achievement Portfolio:

- Best Trade Execution Global - Global Business Review Magazine

- Best IB Programme Global - Global Business Review Magazine

- Best Customer Service Broker LATAM - Global Business Review Magazine

- Best Forex Broker Asia - Global Business Review Magazine

- Best Forex Broker Asia - Brands Review Magazine

- Best IB Program - Brands Review Magazine

2022 Award Collection:

- Best Customer Experience Broker - Forex Broker Awards

- Best CFD Broker MENA - Global Business Review Magazine

- Best Forex Broker LATAM - Global Business Review Magazine

- Best Trading Conditions Broker Asia - International Business Magazine

- Best Trading Conditions Broker Global - International Business Magazine

- Most Transparent Broker - World Finance Awards

- Best Deposits & Withdrawals Broker

This comprehensive award portfolio validates M4Markets' sustained commitment to excellence across multiple operational areas, including execution quality, customer service, and regional market leadership, demonstrating consistent improvement in service delivery standards over several years..

Final Assessment: Is M4Markets Worth Your Investment?

Based on a comprehensive analysis of the regulatory framework, trading conditions, client feedback, and operational transparency, our conclusion is that M4Markets is regulated broker that emerges as a legitimate and trustworthy option suitable for diverse trading requirements.

Ideal Client Profile:

- Beginning traders seeking low minimum deposits and educational support

- Scalpers requiring tight spreads and fast execution speeds

- Multi-asset traders wanting diversified instrument access

- International clients needing multi-jurisdictional regulatory protection

Cost-Benefit Analysis: M4Markets provides competitive pricing structures with transparent fee disclosure, making it suitable for both low-volume retail traders and high-frequency professionals. The combination of multiple account types and flexible leverage options accommodates various capital levels and risk appetites.

Safety and Legitimacy Confirmation: The broker's multi-jurisdictional regulation, segregated fund policies, and consistent positive client feedback confirm its legitimacy as a trading partner. Industry experts consistently rate M4Markets as a reliable and reputable broker with strong regulatory compliance.

Recommendation: M4Markets represents a solid choice for traders seeking regulated, cost-effective trading conditions with comprehensive educational support and professional customer service.M4Markets is not a scam but rather a legitimate, multi-regulated trading broker offering competitive conditions, comprehensive educational support, and reliable customer service.

The broker's strong regulatory framework, positive client feedback, and transparent operational practices confirm its status as a trustworthy trading partner for international forex and CFD traders.

Frequently Asked Questions About M4Markets

Is M4Markets properly regulated and safe?

Yes, M4Markets holds multiple regulatory licenses from CySEC (Cyprus), FSA (Seychelles), and DFSA (Dubai), providing comprehensive client protection and regulatory oversight across different jurisdictions.

What is the minimum deposit requirement?

M4Markets offers flexible minimum deposits starting from $5 for Cent accounts, $100 for Standard accounts, $500 for Premium accounts, and $200 for Raw Spread accounts.

Does M4Markets accept traders from the United States?

No, M4Markets does not accept clients from the United States due to regulatory restrictions. The broker primarily serves European, Middle Eastern, African, and Asian markets.

How can I withdraw funds from my M4Markets account?

Withdrawals are processed through the same method used for deposits, typically taking 1-5 business days. Supported methods include bank transfers, credit cards, and e-wallets like Skrill and Neteller.

Is M4Markets suitable for beginners?

Absolutely. M4Markets offers Cent accounts with $5 minimum deposits, comprehensive educational resources, demo accounts, and responsive customer support, making it an excellent choice for novice traders learning market fundamentals.